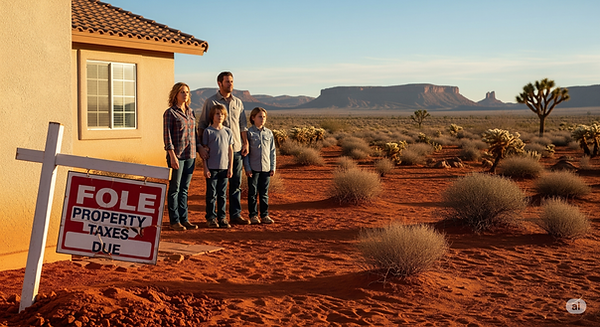

Property Taxes

Thankfully, the raises for our fire and police personnel were included in the budget and were already in place regardless of the outcome of the property tax increase, as confirmed by our City Manager, Chuck Gilette, "Yes, they have already received the raises that were budgeted." (texted on the record as of Wednesday, October 15th, 2025)

Police & Fire Raises Were Already Budgeted

Read my Article for Many Ways to Avoid a Property Tax Increase HERE

I do not support raising property taxes in Ivins. Property taxes should be supplemented, as they are in most municipalities, by sales tax revenue, grants, fees, and other sources. For that reason, property taxes should remain stable and not increase. I was especially concerned about some of the reasons given for the recent tax increase:

-

It had been 15 years since the last increase.

-

Our rates were lower than most other municipalities in the state.

-

It was needed to maintain the "level of service”.

I don’t believe these are strong reasons to raise taxes on Ivins residents. Instead, the city should first look for smarter ways to balance the budget without adding financial pressure on homeowners. Download an easy to read budget analysis as provide by Fred Birnbaum HERE.

-

IDEA 1: Use savings strategically | Since the city overbudgeted, savings should cover the shortfall this year, followed by targeted spending adjustments to avoid deficits next year.

-

IDEA 2: Delay new hires and purchases | Hold off on hiring additional grounds maintenance or shelter staff, along with the associated vehicle purchases, until the expected revenue from nightly room taxes arrives.

-

IDEA 3: Reconsider non-essential projects | For example, the proposed cemetery fence could be postponed. If it is a priority, community groups like Ivins Inspired could help fundraise instead of using city funds.

-

IDEA 4: Prioritize “needs” over “wants” | Focus resources on core services—public safety, water, infrastructure—before funding new amenities.

-

IDEA 5: Expand external funding | Aggressively pursue state and federal grants, public-private partnerships, and tourism-related revenues to support city services and improvements without increasing taxes.